In Latin, univerbation of pomo (“apple”) + d’ (“of”) + oro (“gold”), literally “golden apple”. Perhaps because the first tomato cultivars to reach Europe and spread from Spain to Italy and North Africa were yellow. Pomodorino, which translates as ‘cherry tomoto’ in Italian, is the name chosen for the pizza restaurant in Greece.

Concept 1, Pomodorino Pizza and Friggitoria Napoletana Restuarant logo

Concept 1 Pizza box mockup

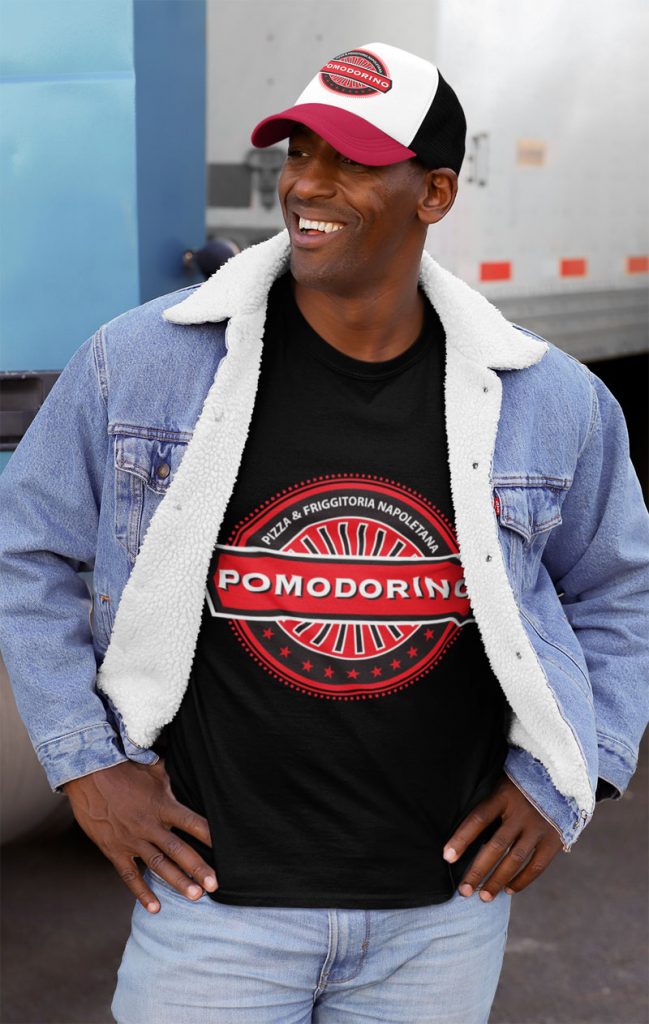

Concept 1 logo transfer to a T-shirt mockup.

Use of the Concept 1 logo in various promotional designs and layouts.

Concept 2: Logo on mug mockup. Two colours on dark background.

Concept 2 Promotional merchandise. Mockup of a t-shirt showing how the logo stands out against a dark background.

Concept 3. Cherry tomatoes and the door of the pizza oven were combined to produce the third concept.

Concept 4 was the final design selected. The carefree, relax, and informal vibe that the business owner wants to portray is reflected in the usage of free-style fonts and illustrations.

Concept 4 was the final selected logo for Pomodorino Pizza and Friggitoria Napoletana Restuarant

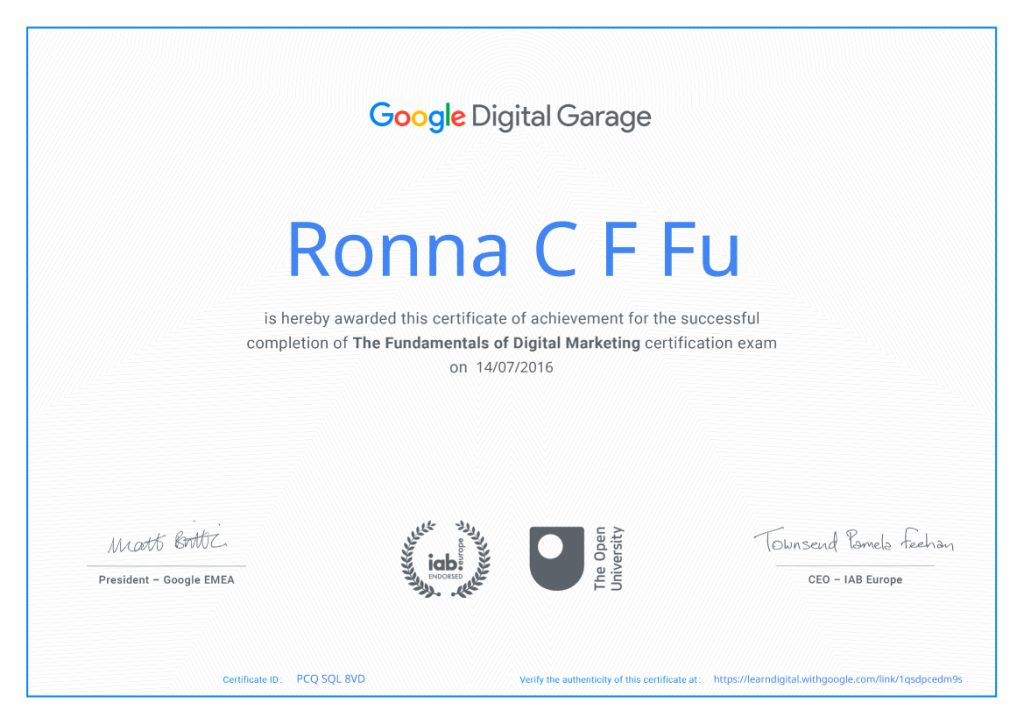

The Fundamentals of Digital Marketing Certification. A forty hours and twenty-six modules course by Google.

The Online Opportunity

Your First Steps in Online Success

Build Your Web Presence

Plan YOur Online Business Strategy

Make it Easy for People to Find A Business on the Web ( 5 topics)

1. Get Started with Search

2. Get Discovered with Search

3. Make Search Work for You

4. Be Noticed with Search Ad

5. Improve Your Search Campaign

Reach More People Locally, On Social Media or on Mobile (7 topics)

1. Get Noticed Locally

2. Help People Nearby Find You Online

3. Get Noticed With Social Media

4. Deep Dive Into Social Media

5. Discover the Possibilities of Mobile

6. Make Mobile Work for You

7. Get Started with Content Marketing

Reach more customers with advertising ( 4 topics)

1. Connect Through Emails

2. Advertise on Other Websites

3. Deep Dive Into Display Advertising

4. Make the Most of Videos

Track and measure web traffic (3 topics)

1. Get Started with Analytics

2. Find Success with Analytics

3. Turn Into Insights

Sell products or services online (2 topics)

1. Buld Your Online Shop

2. Sell More Online

Take a business global (1 topic)

1. Expand Internationally

I completed a course in creating presentations, documents, data visualizations, videos and other branded contents using Visme. Visme is a powerful online tool that allows users to create, edit, share, and store visual content. It may be uses as a presentation programme to create slide decks, but you can also design templates for visuals for letterheads, infographics, charts, logos, and storyboards.

How secure is your contactless bank card?

Have you ever wondered that if someone could get close enough to you and your contactless bank cards, they could somehow capture the data and use it in fraud? Well, the simple answer is they can’t. (According to global business Thales Group)

The link below, details some myths and facts that will explain why your contactless card/s are safe from being skimmed, whether they are in some form of protective wallet or not.

Read here for more information.

For those of you that use Amazon.co.uk you may already have been informed that as of January 19th 2022, Amazon will not accept Visa credit cards for payment.

I note with interest, that they advise you to replace the card with either a Debit Card or another credit card issuer.

Please remember, that using a credit card to online shop provides you with more consumer protection than using your debit card.

Using a credit card, you are spending someone else’s money until you pay it back.

Using a debit card, you are spending your own money.

I like to try and predict how the criminals will react to the Amazon announcement, so I would not be surprised and I urge you to be alert to the fact, that criminals will exploit this situation to send phishing communications that appear to come from Amazon, inviting you to click on a link so you can change the card details on your account.

May I suggest, that you access your Amazon account (or any online account) via the genuine website or genuine app, not via a link in a text, email or social media message.

Mr Nigel Sutton 8517

Fraud and Cyber Security Advisor

Serious & Organised Crime (Intelligence and Specialist Crime Department)

Ext: 01480 422773

Cambridgeshire Constabulary

Hinchingbrooke Park,

Huntingdon, PE29 6NP

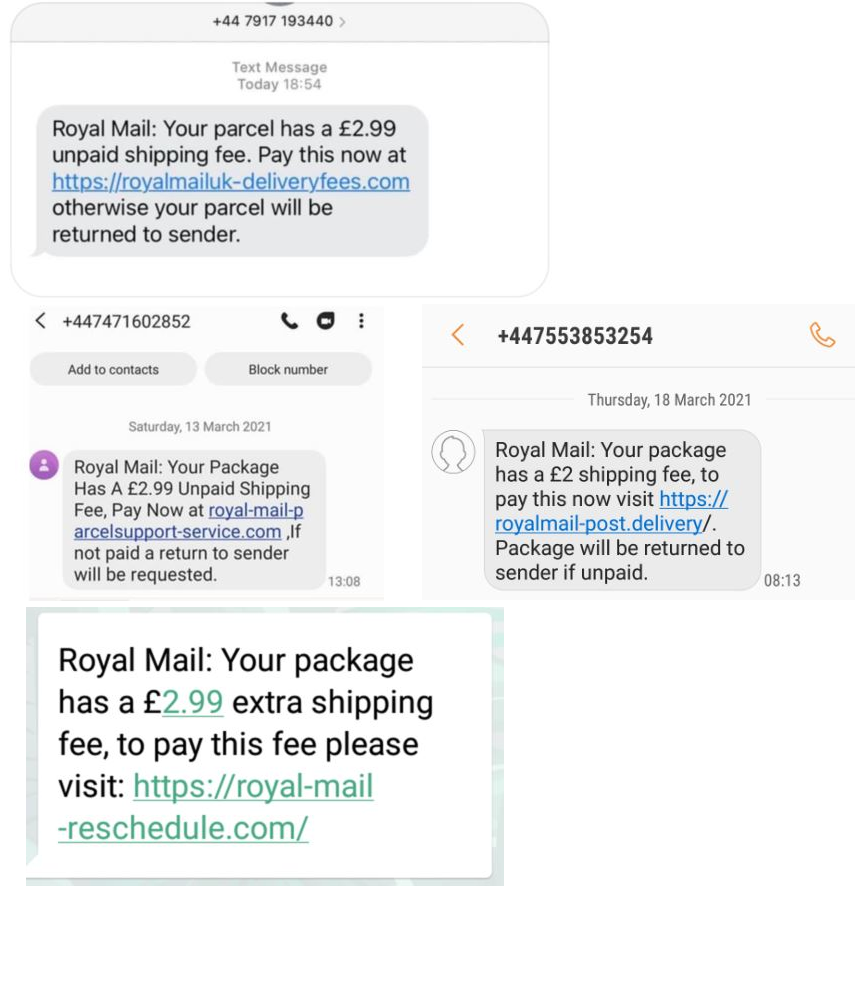

The Cambridgeshire and Peterborough Against Scams Partnership, are warning us all of a scam text message purporting to be from Royal Mail.

On the 13th October 2020, Microsoft released a significant update to all users of Windows 10 OS. (CVE-2020-1047) (If you use Windows OS on a work computer, then updates may be managed by your ICT)

The update fixes 87 vulnerabilities with one having a Microsoft severity score of 9.8 out of 10 and has been described as dangerous. This bug can allow a criminal to take over any Windows operating system that has not been patched.

The second issue of note relates to Outlook in which the bug can be exploited by tricking the user into opening a specially crafted file with an affected version of the Microsoft Outlook software.

You may already have updates set to Automatic, but please check just in case the updates have not been applied.

To do this, click on the magnifying glass on the taskbar bottom left of your screen, then in the search bar start typing ‘windows update’, and you will then see Windows Update Settings appear, click on this and follow the instructions.

These are a few samples of my work available in digital format. If you’re looking for something specific, please get in touch with Ronna.

We are still working on our website adding new information on a regular basis. Please drop us a line if you can’t find what you are looking for.

To view my posts on online securities, please select the link Online Securities on the right.

I collected information on this subject from reliable sources like the police online scurity team and the Neighbourhood watch team. Sometimes we can be overhelmed with so many messages bombarded at us from so many sources that we missed out the important ones. The idea of having it in one place is to give you the freedom to browse through your own time and space.